LISD seeks voter input

The Liberty Independent School District Board of Trustees is seeking input from LISD voters this November. Our trustees are facing challenges that are associated with a rapid decline in property valuations.

The certified appraisal valuations for properties within Liberty ISD dropped drastically over the past year. A major cause is the loss in value of the largest taxpayer in our district, Boomerang Tube, who accounted for 12% of our tax property values. The valuation of this company dropped from $115 million in 2020 to $68 million in 2021, which gives the district a loss in valuations of $47 million.

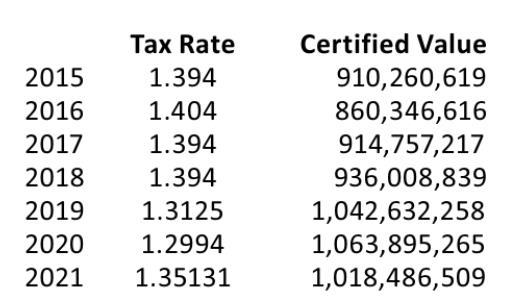

Each year, one of the most critical roles of a public-school board of trustees is to set the annual tax rate. Trustees must approve a tax rate that will provide the district with quality education for our students. Property values are a primary consideration in driving the board’s decision on setting the tax rate from year to year. Our trustees have consistently lowered the tax rate since 2018 as you can see in the graph below.

LISD Trustees recently voted unanimously to adopt a tax rate of $1.35131 for the 2021-2022 school year. While this is a higher tax rate than it was in 2019 and 2020, it is lower than in 2015, 2016, 2017, and 2018.

Failure to adopt this tax rate will result in a deficit budget of $1.2 million dollars for 2021-2022 and each year thereafter. It is important to note that approximately 75% of our annual budget provides salaries for teachers, bus drivers, and all LISD employees.

In order for the board approved 2021 tax rate of $1.35131 to take effect, it must be approved by voters in the November general election.